Loan Tracking Methods: Spreadsheets vs Modern Lending Software

For decades, spreadsheets have been the go-to tool for tracking loans. Easy to open, easy to customize, and familiar to every finance team, Excel or Google Sheets feel like a “safe” choice.

But here’s the problem: what worked when you had a handful of clients quickly turns into chaos once your loan portfolio grows. Loan officers spend hours updating cells, version control becomes a nightmare, and a single missed formula can ripple into serious compliance issues.

And let’s not even talk about the stress of managing repayments or calculating interest when 10 different people are working on the same spreadsheet.

Spreadsheets may have their place, but in today’s lending environment, they’re not enough. Modern lending software is built to handle the complexity, compliance, and speed lenders need, and this blog will break down how the two approaches stack up.

Loan Tracking with Spreadsheets: Familiar but Flawed

Spreadsheets have been the “Swiss Army knife” of finance for years. They’re flexible, affordable, and nearly everyone knows how to use them. For small lenders just starting out, they can feel like the easiest way to keep track of loans.

The upsides:

- Cost-effective: Free or low-cost compared to investing in new software.

- Customizable: You can design your own formulas, reports, and dashboards.

- Accessible: No special training required — everyone knows their way around Excel.

Sounds great, right? But once you scratch the surface, the cracks start showing.

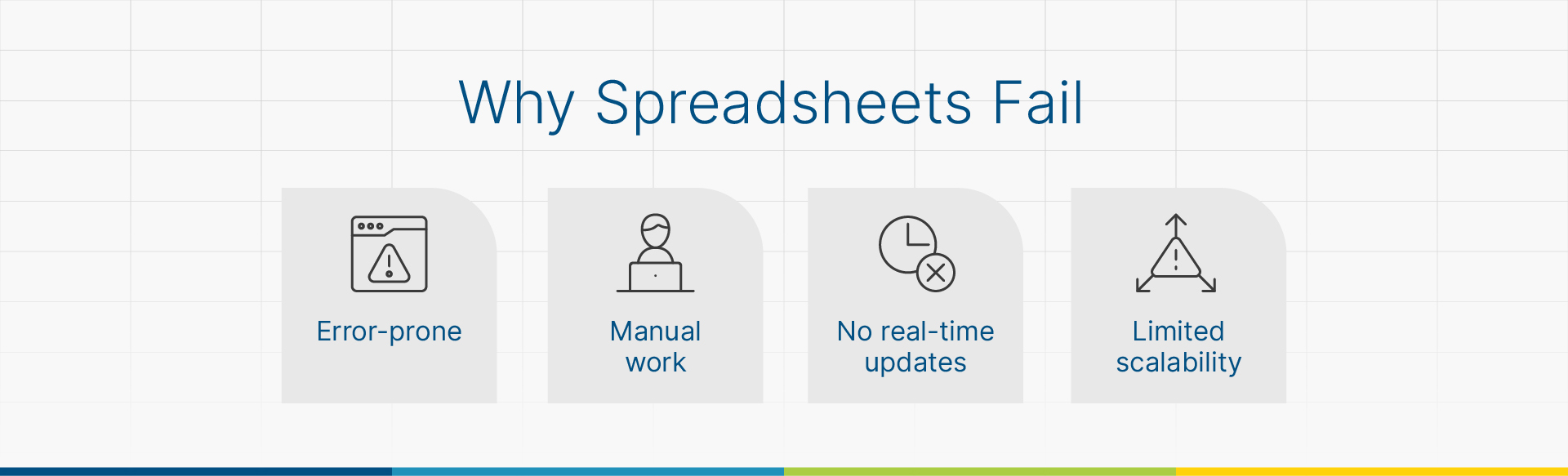

The downsides:

- Error-prone: A misplaced decimal or broken formula can throw off entire repayment schedules.

- Lack of automation: Everything — from interest calculations to reminders — needs manual input.

- No real-time updates: If multiple people are working on different versions, data accuracy is always at risk.

- Scalability issues: Tracking 20 loans is doable. Tracking 2,000? Practically impossible without errors piling up.

- Weak security & compliance: Spreadsheets aren’t built for audit trails or regulatory checks.

Imagine a loan officer juggling hundreds of accounts across 15 spreadsheets. One forgotten update, and a borrower misses a payment notification. The lender loses revenue, the borrower loses trust — and all because of a manual system straining under pressure.

Spreadsheets were never designed to be full-fledged loan tracking systems. They’re a temporary fix, not a long-term solution.

Modern Lending Software: Built for Growth

Where spreadsheets start to buckle, modern lending software steps in to take the weight off. These platforms aren’t just digital versions of Excel; they’re purpose-built systems designed to manage the entire loan lifecycle — from origination to repayment.

The upsides:

- Automation at scale: No more manual calculations. The system auto-updates balances, interest, and repayment schedules.

- Real-time dashboards: Loan officers and borrowers can see the status of loans instantly, instead of waiting for someone to update a sheet.

- Integration-friendly: Connects with CRMs, accounting software, and payment gateways so data flows seamlessly across your operations.

- Built-in compliance: Many platforms include audit trails, access controls, and alerts that help meet regulatory requirements.

- Data security: Unlike spreadsheets floating around on email attachments, modern systems use encryption and secure cloud hosting.

- Scalability: Whether you’re managing 50 loans or 50,000, the system is designed to grow with you.

The downsides? There are a couple:

- Upfront cost: Most modern software works on a subscription or licensing model. It’s an investment, though one that usually pays off in efficiency gains.

- Training required: Your team may need time to adapt to the new platform. But once they do, the long-term benefits outweigh the short learning curve.

Here’s the kicker: a loan officer who once spent hours juggling multiple spreadsheets can now log into a dashboard, see every borrower’s repayment status in real time, and get automated alerts for upcoming dues. That’s not just convenient — it’s transformative and intelligent lending.

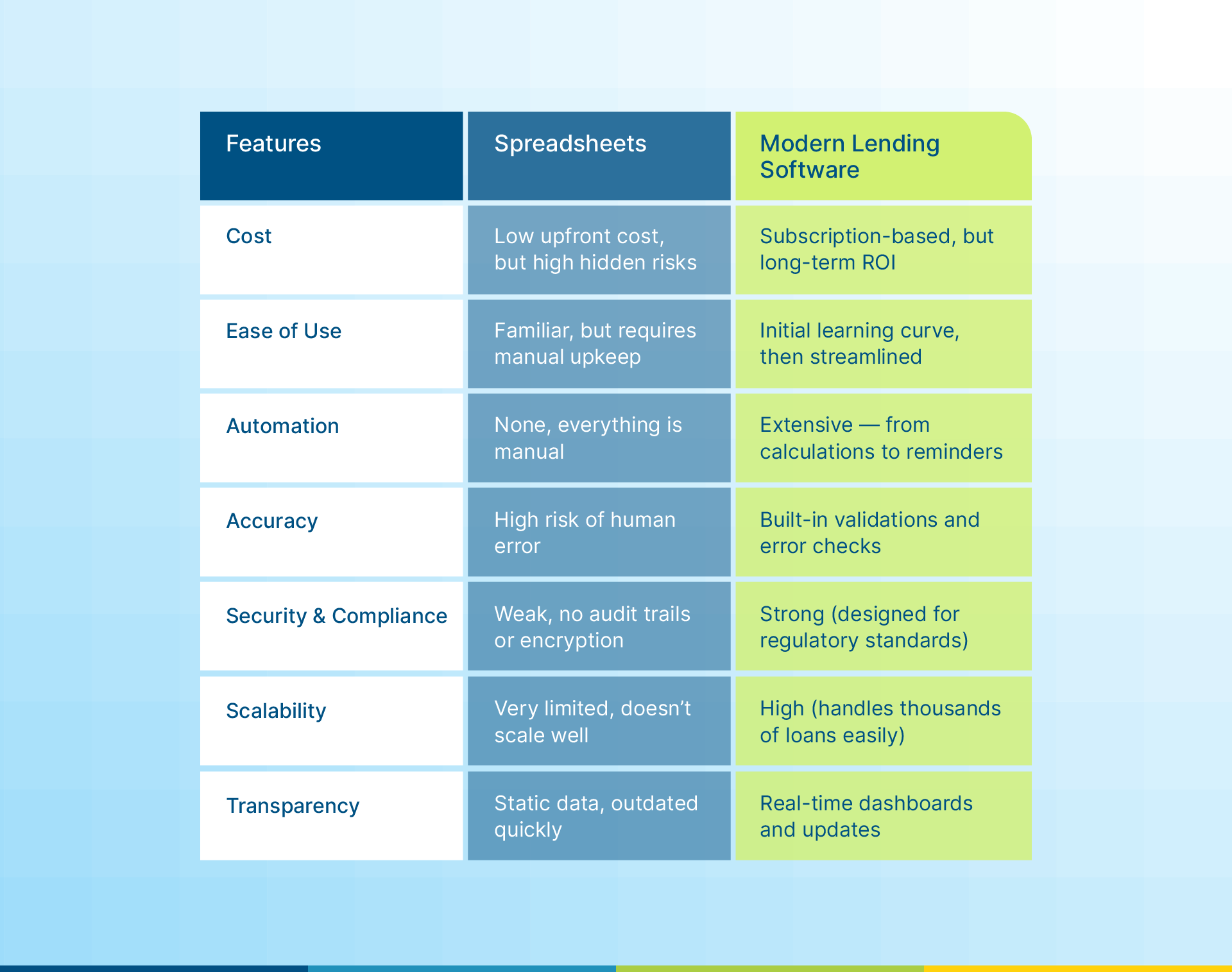

Spreadsheets vs. Modern Lending Software: A Side-by-Side Look

At the end of the day, both spreadsheets and software can help track loans — but the difference lies in efficiency, accuracy, and scalability. Let’s break it down:

Here’s the big takeaway: spreadsheets may “get the job done” when your portfolio is small. But as soon as you’re dealing with scale, compliance, and customer expectations, modern lending software isn’t just better — it’s necessary.

The Real Impact: Customer Experience

It’s not just lenders who feel the pinch of outdated systems — borrowers do too. When loan tracking is stuck in spreadsheets, the customer experience often takes the hit.

How spreadsheets hurt borrowers:

- Delays in processing: Borrowers wait longer for approvals or repayment confirmations because everything is updated manually.

- Lack of transparency: Customers can’t easily see where their loan stands — they’re dependent on loan officers for updates.

- Errors with real consequences: A miscalculated repayment schedule or missed reminder could mean late fees or even a dent in someone’s credit score.

Now, compare that with modern software:

- Real-time visibility: Borrowers and lenders both have access to up-to-date loan information.

- Automated reminders: No more missed payments due to human error.

- Smoother communication: Integrated systems make it easier to notify customers about changes, deadlines, or approvals.

Think about it from a borrower’s perspective: Would you trust a lender who’s always late with updates, or one who gives you instant notifications and accurate repayment schedules? The difference between spreadsheets and modern software is more than operational — it’s reputational.

Which One Should You Choose?

If you’re a small lender handling a handful of loans, spreadsheets might still feel manageable. They’re cheap, familiar, and flexible enough for limited operations.

But once you start growing, or if compliance and accuracy are priorities, spreadsheets become a liability. Errors pile up, customers get frustrated, and scaling your portfolio feels like pushing uphill.

Modern lending software, on the other hand, is designed for growth, accuracy, and efficiency. It takes the manual headaches out of loan tracking, keeps regulators happy, and — most importantly — creates a better experience for borrowers.

The bottom line: Spreadsheets are a stopgap. Modern software is the future.

Explore Prizm Lending Suite to see how a modern and intelligent lending platform actually transforms your loan tracking. It’s a lending solution built to streamline operations, reduce errors, and scale with your business.

FAQs

- What is a loan tracking system?

A loan tracking system is a tool that helps lenders monitor loan disbursements, repayments, and balances. It ensures accuracy, reduces errors, and provides visibility across the loan lifecycle.

- What is lending software?

Lending software is a digital platform designed to manage the full loan process—from origination to repayment—offering automation, compliance features, real-time tracking, and scalability for lenders.

- What are the limitations of using spreadsheets for loan tracking?

The limitations of spreadsheets for loan tracking include error risks, lack of automation, poor scalability, weak security, and difficulty in meeting compliance standards as loan volumes grow.

- How does modern loan tracking software improve efficiency?

Modern loan tracking software improves efficiency by automating calculations, sending reminders, offering real-time dashboards, reducing manual work, and ensuring accurate, compliant operations.

- Is loan management software suitable for small lenders or NBFCs?

Yes, loan management software is suitable for small lenders and NBFCs. It scales with growth, improves accuracy, and streamlines operations even at low volumes, making it a future-ready choice.

How do modern loan tracking methods improve borrower experience?

Modern loan tracking methods improve borrower experience with real-time updates, automated reminders, transparent repayment schedules, and fewer errors—building trust and satisfaction.

%201.avif)